The data revolution has created seismic impact in every business sector, from life sciences to tourism, but few industries have experienced a technology-driven disruption quite like finance.

The Hanlon Financial Systems Center at Stevens Institute of Technology is the first facility of its kind in the United States, one that encourages the application of cutting-edge technologies in unique and creative ways to solve complex, systemic financial problems; uncover and exploit new opportunities through statistical analysis and modeling; challenge the conventions surrounding valuation and trading strategy; and manage the risks of interconnected markets.

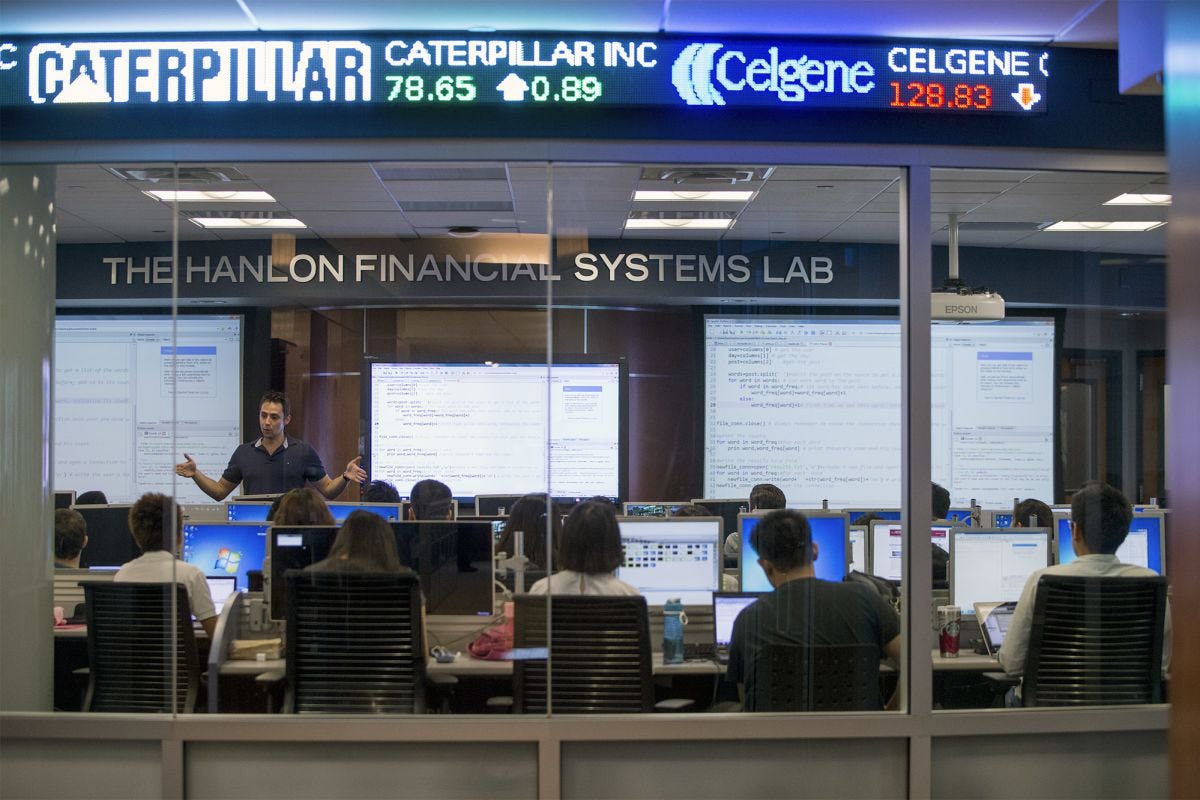

Game-Changing Financial Analytics Labs

The center is home to two state-of-the-art financial systems labs, each of which contains powerful hardware and leading-edge software tools that replicate the look and feel of the technologies in place at finance companies. These labs challenge students to apply lessons in asset pricing, risk management, portfolio strategy and cybersecurity to real business problems.

One-of-a-kind Educational Possibilities

Students and partner companies enjoy incredible benefit from the Hanlon Financial Systems Center. Technology in the labs allows students to think critically about, and apply lessons in, machine learning, data visualization and risk engineering to the kinds of challenges they'll face at work. Partner companies send employees to software boot camps, lectures and workshops to stay current with changing technologies.

Degree programs

Finance programs leverage the Center and its lab facilities to immerse students in world-class technology.

Executive Education

The Hanlon Financial Systems Center is uniquely equipped to provide executive training modules that teach working professionals how to use technology, data and analytics to uncover new opportunities and solve complex problems in the financial space.

The School of Business maintains close ties to managers, executives and recruiters on Wall Street and at nearby Fortune 500 companies, to ensure course material and technology components are up-to-date in a fast-changing work environment. Stevens faculty also regularly travel to companies in and around the New York City area to meet with decision-makers and teach graduate courses to aspiring managers in a variety of industries.

> More information on Corporate and Executive Education

Certificate programs

Creating Impact through Research

Research at the Hanlon Financial Systems Center spans areas ranging from financial engineering, statistics and econometrics to electrical engineering, artificial intelligence and cognitive computing.

We are grateful to our benefactors Sean and Cathy Hanlon. Sean, a Stevens Trustee and Alumnus, had a vision for a state-of-the-art financial technology and teaching center to create a dynamic connection between financial theories and real-world practices. The HFSC and associated labs integrate the latest hardware and software technology, accessing real-time data and historical data, supporting innovative research into the most common and urgent problems in contemporary finance.