Stevens' leadership in thinking about how new and emerging technologies disrupt existing business practices and create opportunities for managers comes from the kind of research and education done through the two labs of the Hanlon Financial Systems Center. State-of-the-art tools in these labs power faculty inquiries into risk management, innovation adoption, asset valuation, regulation, technology strategy, algorithmic trading, cognitive computing and cybersecurity.

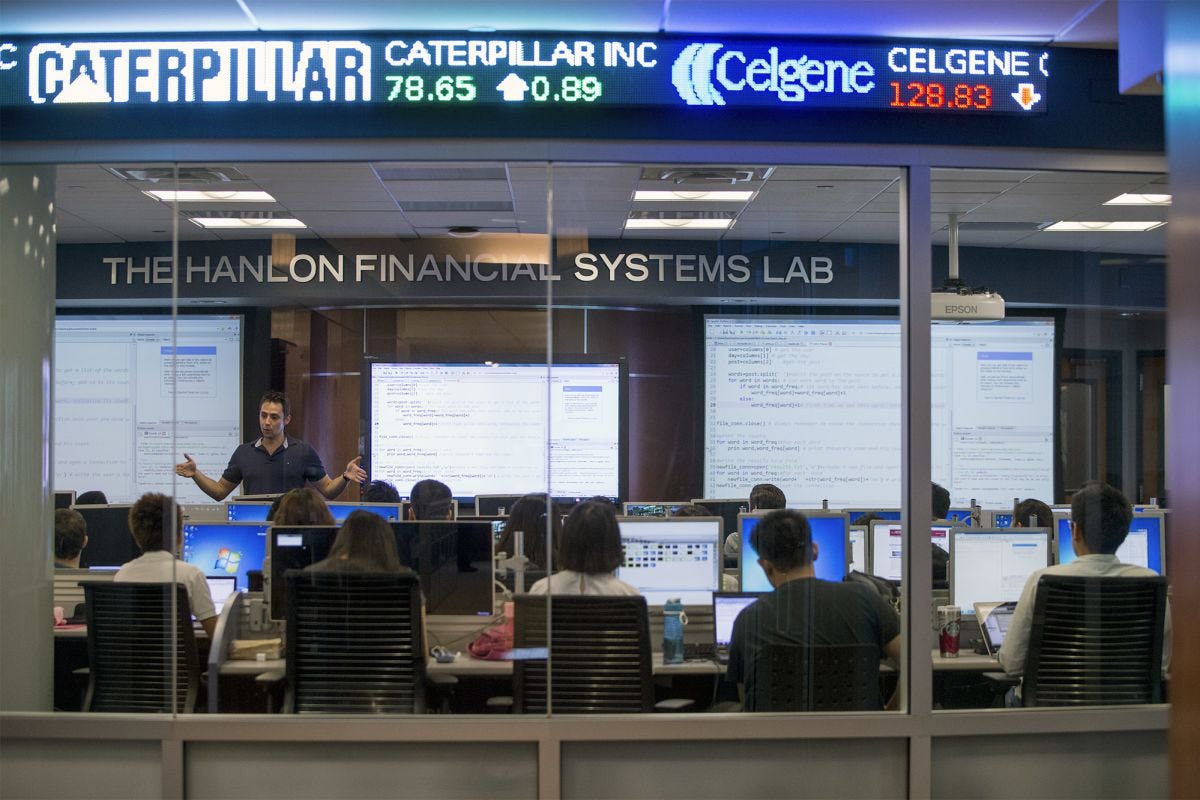

Hanlon Financial Systems Lab

This high-tech facility commands an incredible view of New York City — fitting, as the technology within is in play at the financial firms of Wall Street. Students and researchers have access to a range of databases, such as WRDS, One Tick, Thomson Reuters Tick History and Thomson Reuters News Analysis. Programming staples like R and Python are learned alongside more complex offerings, such as Hadoop and Gurobi.

Among the most important tools in the lab are its 12 Bloomberg terminals. Undergraduate students in the Quantitative Finance program earn Bloomberg certification during the freshman year, giving them an important skill that sets them apart during internship and job interviews.

Data is coming through financial markets today with greater speed and detail than just 10 years ago; investment professionals must be able to use analytic engines to visualize the data, or they will be caught flat-footed when market opportunities arise. This lab incorporates the visualization capabilities investors need to make better, faster choices to support portfolio health and the growth of the enterprise. Uniquely, the lab is outfitted with the same technology on the front end of IBM’s Watson platform; its Mezzanine platform shows students creative new ways to collaborate and present to an audience anywhere in the world.

This wide-scale deployment of Mezzanine is the first of its kind in a university classroom setting. These cutting-edge tools are offered in addition to the Bloomberg and other technologies available in the Hanlon Financial Systems Lab.

Selected lab technologies

WRDS

Thomson Reuters Tick History

Thomson Reuters News Analysis

OneTick

Bloomberg

Tableau

Mathematica

Mezzanine

Gurobi

Matlab

RStudio

Jupyter

Compustat

SAS

Python

Hadoop

About Oblong

The Mezzanine system in use at Stevens is the first deployment of its kind in a university lab setting, and enables presentation and collaborative capabilities that add a new dimension for the development of core business skills. Through this technology, Stevens is changing how students learn and better positioning them to manage evolving technologies when they enter the workplace. Students take active roles in classroom discussions by adding data or context to presentations, and encouraging multiple teams of students to interact with Bloomberg and other data sets simultaneously in real time.

A top flight center for finance and technology

Capital Markets Research

The technology tools in the Hanlon Financial Systems Lab enable faculty to perform leading-edge research.

Trading Day

The School of Business hosts an annual trading competition between sophomore and junior high school students using the Hanlon Lab’s top-flight tools and real-time data.

High-Frequency Conference

The annual Conference on High-Frequency Finance and Data Analytics features new research insights in data science, finance and computer science with invited guests from prestigious universities and top companies, including Facebook, Bloomberg and Mizuho.

Finance master's program

Students use technology in the Hanlon Lab to better understand the quantitative, analytical tools that continue to reshape finance.