Fintech is Digital Finance

That is, it deals with the application of advanced digital technologies to all aspects of the financial system.

The “fin” in fintech includes:

design and operation of financial market infrastructure systems – exchanges, custody, clearing and settlement systems

banking services, credit creation, digital currencies, and payment systems,

asset valuation, asset management and investment portfolio construction

design and testing of innovative financial instruments and strategies

stress-testing and error-control applied to all aspects of the financial system

Corporate treasury functions, including cash management, risk control policies and capital structure decisions

secure execution of financial transactions

“smart” contracts and other forms of automated financial accounting

risk management across the entire spectrum of financial services, including cyber- security countermeasures

other cloud-based financial service

The “tech” in fintech

The technologies involved have developed in the fields of science, mathematics, and computer engineering, and are penetrating and disrupting the financial system. They include:

machine learning and artificial intelligence of many different kinds

advanced hedging and risk engineering techniques

financial platform simulation

distributed ledger technologies (e.g., blockchain)

advanced forms of index construction

quantum computing and communications

advanced optimization modeling techniques

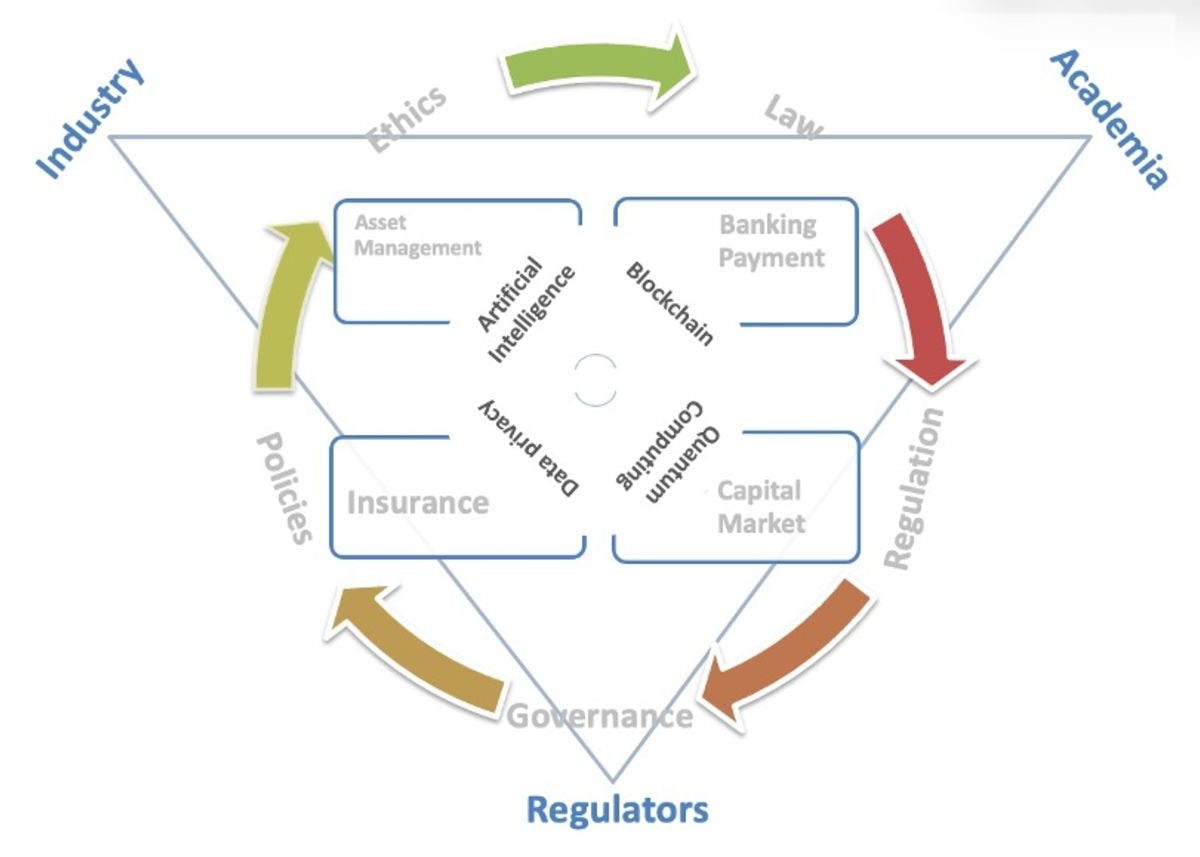

Fintech Ecosystem

Fintech Research Focus

Fintech is digital finance. It involves the enhancement or replacement of traditional low- tech financial processes with advanced technologies from many other fields. It is inherently multidisciplinary. Relevant research will involve collaborations across many traditional academic fields.

CRAFT will carry out fintech research that will apply advanced techniques and technologies from many of these fields to emerging applications in the financial services industry.

Some of the relevant technologies include:

Machine Learning (ML) and Artificial Intelligence (AI) – to discover and exploit subtle patterns in large datasets

Natural Language Processing (NLP) – to extract useful signals from data- sets derived from written or spoken human language

Quantum Computing & Communication – using quantum techniques to improve computation speed and security

Blockchain & Distributed Ledger technologies – designing self-regulating networks and processes for managing various types of data assets

Advanced Optimization techniques – to apply powerful mathematical models to complex decisions

Applications to the financial services industry could include:

Improved Credit risk analysis using ML/AI

NLP applied to extract investment signals from financial text data, or to detect potential fraud or errors in financial statements

Portfolio Construction and Immunization using advanced optimization

AI-based tools for asset management and wealth management

Risk engineering applied to control model risk, process risk, and other forms of business and financial risk

Modeling & simulation of high frequency behavior of financial markets

Blockchain applications to improve financial processes such as clearing, settlement, and “smart contracts”

Quantum tech applied to generate high-quality randomness sources to support financial modeling and risk assessment (Monte Carlo), and enhanced cybersecurity techniques